RBI's cautious position puts pressure on the market, causing selling in interest rate-related sectors' shares

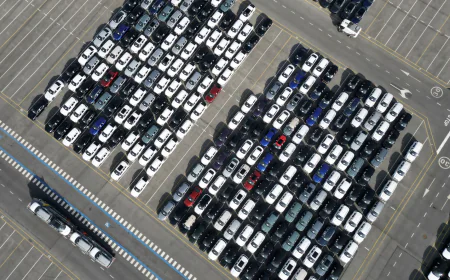

Share Market: RBI decided to keep the repo rate stable at 5.5 percent. After this, interest sensitive auto, realty and bank shares in the stock market fell by five percent.

Repo rate unchanged marked RBI's decision which increased fall in rate sensitive sectors. Interest-sensitive auto, realty and bank shares decline by 5%.

Bosch's stock at BSE lost 4.85% at Rs 38,617, Hyundai Motor India lost 1.95% at Rs 2,146.15, Hero Moto Corp lost 1.31% at Rs 4,482.60, Apollo Tyres lost 1.07% at Rs 435.10 and Mahindra & Mahindra lost 0.83% at Rs 3,183.50.

Besides this, Ashok Leyland share declined 0.78% to Rs 120.95, TVS Motor Company share declined 0.67% to Rs 2,962.75, Tata Motors share declined 0.57% to Rs 650.90 and Maruti Suzuki India share declined 0.04% to Rs 12,520.

Want to get your story featured as above? click here!

Want to get your story featured as above? click here!

On the other hand, Bajaj Auto rose 0.11% to Rs 8,239.35 and Eicher Motors rose 0.03% to Rs 5,681.80 per share. The BSE Auto Index fell 0.85% to 52,907.31.

Among realty stocks, Prestige Estates Projects fell 2.68 per cent to Rs 1,566.20, DLF fell 2.65 per cent to Rs 760.05, Godrej Properties fell 2.42 per cent to Rs 2,063.55, Phoenix Mills fell 2.40 per cent to Rs 1,439.65 and Brigade Enterprises fell 2.27 per cent to Rs 969.70.

Shares of Anant Raj also fell 2.03 per cent to Rs 548.50, Lodha Developers fell 1.54 per cent to Rs 1,214.60, Oberoi Realty fell 1.37 per cent to Rs 1,586, Signature Global fell 1.38 per cent to Rs 1,127.05 and Sobha Limited fell 1.12 per cent to Rs 1,576.85. The BSE Realty index fell 2.11 per cent to 6,901.55.

Banking stocks were also trading in the red, with Indusind Bank trading 2.58 per cent lower at Rs 798.10 per share, IDFC First Bank falling 1.34 per cent to Rs 68.41, Bank of Baroda falling 0.46 per cent to Rs 239.55, Axis Bank falling 0.16 per cent to Rs 1,068.85 and State Bank of India falling 0.02 per cent to Rs 800.50.

On the other hand, ICICI Bank rose 0.22 per cent to Rs 1,447.50 and HDFC Bank rose 0.18 per cent to Rs 1,980.10. The BSE Bankex fell 0.04 per cent to 61,597.35.

From the financial services pack, shares of SBI Cards and Payment Services fell 2.16 per cent to Rs 786.90, Jio Financial Services fell 1.98 per cent to Rs 326.20, Bajaj Finance slipped 1.78 per cent to Rs 875.60, Bajaj Finserv fell 1.16 per cent to Rs 1,916.95 and LIC Housing Finance fell 0.49 per cent to Rs 576.50 on the BSE. The BSE financial services index declined 0.06 per cent to 12,431.42.

The 30-share BSE Sensex fell 80.99 points, or 0.10 per cent, to 80,629.26 in mid-session trade.

After cutting interest rates for three consecutive times, the RBI on Wednesday decided to keep the policy rate unchanged at 5.5 per cent. This decision has been taken in view of the current state of the Indian economy. Also, the risks arising from uncertainties around US President Donald Trump's trade policies and the possibility of more tariffs are being assessed. Along with this, no change has been made in the estimate on GDP growth. The GDP growth estimate in the financial year 2026 has been retained at 6.5%.