Income Tax: If you want to switch to the old tax regime, then fill this form before July 31

Income Tax: ITR 2024 A new tax regime was announced in Budget 2023. In such a situation, taxpayers have to choose between the new and old tax regimes. If you want to switch to the old tax regime then you have a chance. You can switch it before July 31st. For this, you will have to fill 10IEA form.

If you have also done all the calculations before filing an Income Tax Return (ITR 2024) and now you want to change your tax regime, then this news is useful for you.

When you have calculated the tax you feel that you will get more benefit by filing ITR in the old tax regime. In such a situation, you will have to fill out Form 10 IEA to file an ITR from the old tax regime.

The New Tax Regime has been made the Default Regime. This means that if you do not select any regime then you have automatically moved to the new tax regime. This means that now they will have to fill out a separate form to select the old tax regime.

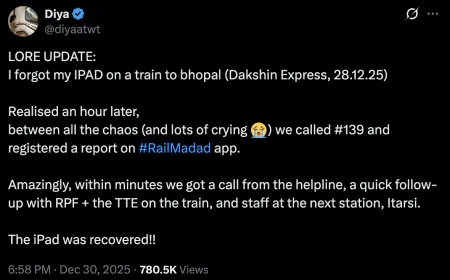

Want to get your story featured as above? click here!

Want to get your story featured as above? click here!

The Income Tax Department has released the tax return form for those who will file ITR this year for the financial year 2023-24. In such a situation, if a taxpayer wants to file ITR in the old tax regime, then he will have to fill out Form 10-IEA.

Ashish Aggarwal, director of Acube Ventures, said "While filling Form 10-I, you will have to provide all the information such as your name, address, PAN card number, income taxpayer code, bank account information and details of your investments. After filling out this form, you will have to provide your passport-size photograph, And a copy of the PAN card has to be submitted. After this, you have to submit this form to your nearest Income Tax Commissioner office."

Further, Ashish Aggarwal says that the taxpayer should note that when he is switching to the old tax regime, he will have to give detailed information about your investments and exemptions. For this, you have to submit a summary to the Income Tax Department regarding your investments.

Also, it's important to keep in mind that when you switch to the new tax regime, you'll have to reclaim your exemptions as well. For this, you will have to submit an application form to the Income Tax Department, in which you will have to apply for your exemptions.

Salaried professionals must fill out Form 10-IEA before 31 July 2024. Please note that this is the last date to file tax returns. To fill Form 10-IEA, the taxpayer will also have to file the return before July 31. However, taxpayers can file ITR as a belated return till December 31, 2024.

Along with the belated return, they will also have to pay a penalty. Note that if taxpayers file belated returns, they will not be able to switch the tax regime. In such a situation, they will have to fill out ITR and Form 10-IEA before July 31, 2024, to switch the tax regime.