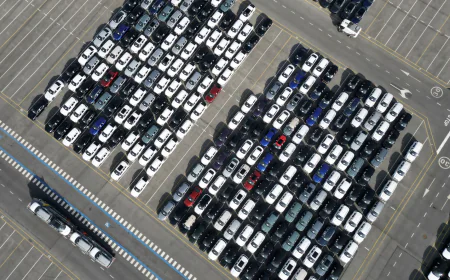

FADA demanded strict action from RBI over private banks delaying the reduction in auto loan rates

Auto Loan: FADA has sought intervention from RBI for not implementing the reduction in interest rates on auto loans by private banks on time. The dealer body wants the benefit of interest reduction to reach the customers immediately.

The country's top auto dealers body, the Federation of Automobile Dealers Association (FADA), has seriously leveled charges against private banks and sought the intervention of the Reserve Bank of India (RBI). According to FADA, whereas government banks are forthwith rolling over the benefit of repo rate reductions on customers, most private banks are consciously holding back the cut in interest rates on auto loans.

FADA Vice President Sai Giridhar wrote a letter to RBI Governor Sanjay Malhotra saying, "Under your leadership, RBI has cut policy interest rates at a historic rate, which has given a big boost to the economy. But its benefits are not visible in the auto retail sector, because private banks are not implementing it." Giridhar said that many banks are delaying the transfer of repo rate cuts to loan rates citing 'internal cost of funds', which is unfair to the customers.

FADA has asked RBI to keep tabs on interest rate pass-through at all banks and provide clear-cut guidelines for passing through rates in the time specified. Further, it has been stated to direct banks to place the cost of funds information in the public domain, so that transparency is provided.

Want to get your story featured as above? click here!

Want to get your story featured as above? click here!

The organization also alleged that auto dealerships registered under MSME often do not get the benefits they should get. Therefore, RBI has been asked to clarify the rules related to MSME.

FADA also said that the benefit of Credit Guarantee Fund Trust for MSE (CGTMSE) should also be given to auto retail, as most dealerships and workshops are outside this scope. Also, reducing the risk weight on auto loans from 100% to 40% like home loans is likely to increase loan disbursements by 20% in the next 5 years.

FADA also highlighted the need for affordable EV financing, lower interest rates and better credit access in rural areas and smaller towns.