5 Tips for buying the best two-wheeler insurance online

Mumbai, Maharashtra, India: Zurich Kotak General Insurance, an insurer shares valuable tips for buying the best two-wheeler insurance online in India. With the increasing number of two-wheelers on Indian roads, having a two-wheeler insurance has become more crucial than ever. Buying a two-wheeler insurance online can be a challenging task, specially for the first-time buyers. Let’s understand the importance and 5 tips for buying the best two-wheeler insurance online.

Want to get your story featured as above? click here!

Want to get your story featured as above? click here!

The importance of two-wheeler insurance

Two-wheeler insurance is mandatory in India, as per the Motor Vehicles Act, 1988. However, it’s benefits extend beyond the compliance as a good two-wheeler insurance provides financial protection against accidents, theft and natural calamities, ensuring peace of mind for the two-heeler riders.

Top 5 tips for buying the best two-wheeler insurance online

Here are top 5 tips for buying the best two-wheeler insurance online:

- Check policy coverage: Make sure that the policy covers third-party liability, personal accident accidents and own damage.

- Disclose accurate information: Always provide accurate information/details about your vehicle and personal information while buying two-wheeler insurance.

- Check No-claim bonus: Check out for policies offering No-claim bonus for consecutive claim-free years.

- Verify policy renewal process: It is important to ensure that the insurer offers hassle-free policy renewal.

- Read policy documents: Carefully read the policy documents and understand the terms and conditions of the coverage.

Benefits of buying two-wheeler insurance online

Here are some of the key benefits of buying two-wheeler insurance online:

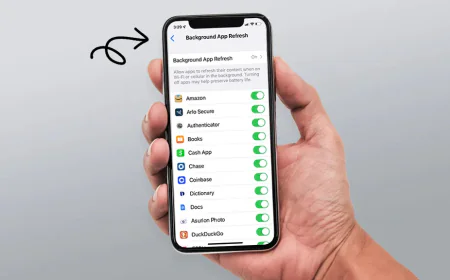

- Convenience: Buying or renewing policies is convenient through online from anywhere, anytime.

- Time saving: It is easy to quickly compare and purchase the two-wheeler insurance through online process.

- Transparency: Buying two-wheeler insurance online offers easy access to policy documents and details.

The final note

Buying two-wheeler insurance online can be a seamless experience if the process is followed correctly. Riders can ensure they have the best two-wheeler insurance coverage for their vehicle, protecting themselves and their loved ones from unforeseen circumstances.

About Zurich Kotak General Insurance Company (India) Limited (Formerly known as Kotak Mahindra General Insurance Company Limited)

Zurich Kotak General Insurance Company (India) Limited is a 70:30 joint venture between Zurich Insurance Group and Kotak Mahindra Bank. The Company got its new name ‘’Zurich Kotak General Insurance Company (India) Limited’’ in the month of August 2024, following Zurich Insurance Group’s 70% acquisition in Kotak Mahindra General Insurance Company Limited. It is the youngest and one of the fastest growing non-life insurance franchises in India.

Kotak General Insurance was established in 2015 to service the growing non-life insurance segment in India. The company aims to cater to a wide range of customer segments & geographies offering an array of non-life insurance products like Motor, Health, Home etc. As a practice, the company seeks to provide a differentiated value proposition through customized products and services leveraging state of art technology and digital infrastructure.