Cybersecurity, Claims Reporting Lapses: IRDAI Cracks Down on Care Health Insurance

Insurance Regulation: IRDA has imposed a fine of Rs 1 crore on Care Health Insurance after finding serious deficiencies in claim settlement and grievance redressal. The investigation revealed deficiencies such as transparency, lack of Ombudsman information, and cybersecurity. The company has been directed to pay the fine within 45 days and present the order to the Board.

The regulator has become stricter regarding transparency and timeliness in the settlement of insurance claims. The Insurance Regulatory and Development Authority of India (IRDAI) has imposed a fine of Rs 1 crore on Care Health Insurance after serious deficiencies were discovered and neglected the interests of policyholders. This action was taken in response to the deficiencies revealed during the inspection.

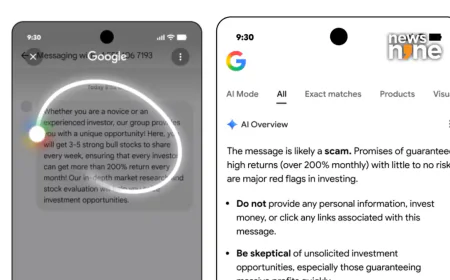

IRDA's investigation found that Care Health Insurance did not follow regulations in its claim settlement, grievance redressal, and reporting processes. In many cases, policyholders were not fully informed of their rights. The regulator has also issued warnings and directives to the company for improvement.

The investigation revealed that even when policyholders' complaints were not resolved in their favor, the company did not inform them of their right to approach the Insurance Ombudsman. The Ombudsman's name and address were also not shared, hindering policyholders from accessing the appropriate forum.

Want to get your story featured as above? click here!

Want to get your story featured as above? click here!

IRDA found that complaint redressal and claim rejection letters only provided customer service contact details, an email ID, and a vague hyperlink. This lack of clear guidelines placed an additional burden on policyholders and prevented them from accessing an effective complaint mechanism.

During the inspection, deficiencies were also found in cybersecurity, reinsurance accounting, and unclaimed balance management. Care Health failed to address the cybersecurity issues within the stipulated time. IRDA clearly stated that transparency in claims and timely communication with policyholders are essential.

According to the regulator, such tactics impact policyholders' rights and undermine trust. Insurance companies have a responsibility to provide accurate information to customers and resolve complaints impartially. Violations of these rules will not be tolerated. IRDA has ordered Care Health Insurance to pay a fine of ₹1 crore from its shareholders' accounts within 45 days of receiving the order. The company must place the order before its board of directors and submit a copy to the regulator.