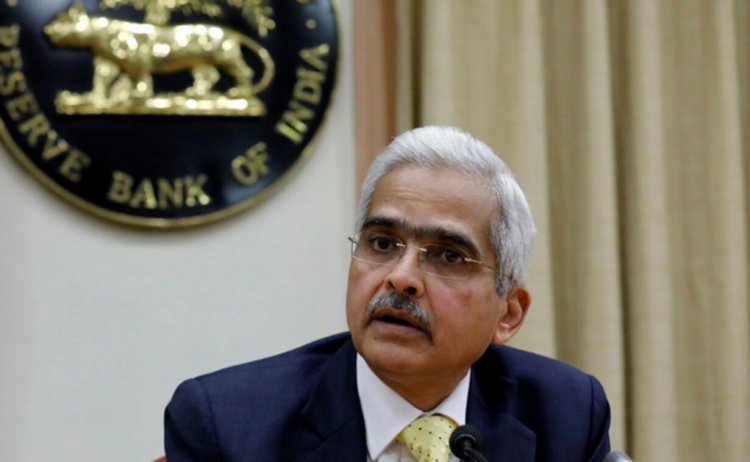

RBI MPC meeting begins to review interest rates, decision will come on October 6

RBI MPC Meeting: RBI MPC meeting will run from October 4 to October 6. RBI MPC consists of six members who make decisions on increasing and decreasing interest rates as per the inflation data, the global economy, and the decisions taken by other central banks. This time it is believed that the repo rate may remain stable.

The meeting of the Monetary Policy Committee (RBI MPC Meeting) of the Reserve Bank of India (RBI) has started from Wednesday (October 4, 2023). This meeting will continue till October 6. Its decision will be announced on the last day of the meeting. It will be done by RBI Governor Shaktikanta Das on October 6.

RBI MPC consists of six members, who make decisions on reducing, increasing, and keeping interest rates stable according to inflation data, the global economy, and decisions taken by other central banks. Earlier in August, an MPC meeting was held, in which the interest rates were kept stable.

Speaking to the news agency PTI, Bank of Baroda Chief Economist Madan Sabnavis said that the credit policy may remain at the current rate structure this time too. For this reason, the repo rate is also likely to remain at 6.5 percent. He also said that the retail inflation rate stood at 6.8 percent in August. It is likely to come down in September and October.

To control inflation, RBI had increased interest rates from May 2022 to February 2023. The repo rate was increased by 0.40 percent in May 2022, 0.50 percent in June 2022, 0.50 percent in August 2022, 0.50 percent in September 2022, 0.35 percent in December 2022 and 0.25 percent in February 2023.