Options Strategy Building Just Got Easier with Samco’s Options Pro

Samco’s Options Pro: Making Options Strategy Development Effortless

New Delhi (India), February 2: Options trading, initially enticing, reveals grim truths upon scrutiny. A recent SEBI study unveils that nearly 90% of F&O traders face losses, averaging ₹1.1 lakhs in FY22. These findings underscore pervasive challenges in options trading, warranting closer examination to understand their impact on traders’ substantial losses.

Want to get your story featured as above? click here!

Want to get your story featured as above? click here!

A Closer Look at What’s Troubling Options Traders

Despite its potential to offer high returns, options trading also comes with various challenges that can be overwhelming for traders. They include:

● Complex Nature of Options Trading

Unlike traditional stock trading, options trading involves multiple factors — like the option’s expiration date, strike price and the volatility of the underlying asset — that can affect the outcome. To navigate this complexity, you need to have a deep understanding of various market dynamics.

● Challenges with Data Analysis

In options trading, crucial data points are often scattered across different platforms. So, it becomes cumbersome to perform a comprehensive analysis of market trends, historical data and economic indicators quickly. This is particularly problematic in volatile markets where timely access to information is critical and you need to make split-second decisions.

● Misleading Perceptions

An option trading is also often mistakenly equated with gambling or lottery wins, perhaps due to the high-risk nature of such trades. However, this misleading perception subverts the strategic aspects of options trading and fails to account for the analytical approach required to trade in the F&O markets.

● Inadequate Risk Management

Another major issue contributing to mounting losses for F&O traders is poor risk management. Even when beginner traders focus on basic strategies like buying calls or puts, they frequently overlook the need for comprehensive risk management. This myopic approach can lead to significant losses, especially in unpredictable markets.

Intricate and Complex Analysis: The Core Challenge in Options Strategy Building

To execute options trading strategies successfully, you need to carry out a thorough analysis of various aspects like the options delta, gamma, vega, theta and implied volatility. Furthermore, you need to analyse the market conditions, choose an appropriate strategy, select the ideal strike price and then enter the position.

This issue becomes even more pronounced if you are dealing with multi-legged trading strategies. Let’s examine how these challenges play out in two strategies — the collar and the straddle.

The Options Collar

To execute the collar strategy, you need to first own the underlying stock. Thereafter, you simultaneously buy an out-of-the-money put and sell an out-of-the-money call.

This multi-leg strategy has a unique profile for options Greek variables. For instance, the delta of this position — which measures sensitivity to stock price changes — is affected by both the put and the call options. If the market conditions are rapidly changing, it becomes increasingly complex to analyse how these deltas interact.

The implied volatility (IV) also influences the pricing of the options used in the collar strategy. You may use the collar strategy to hedge against some downside risk, but if the IV fluctuates significantly, it may alter the effectiveness of this hedge.

The Options Straddle

Here, you may buy (long straddle) or sell (short straddle) a call and a put option of the same underlying asset, with the same strike price and expiry.

This strategy is also highly sensitive to changes in the Greeks, particularly the gamma (i.e. the rate of change of delta) and the vega (i.e. the option’s sensitivity to changes in IV). To balance these aspects and successfully execute the strategy, you need to analyse the different Greeks thoroughly.

Assessing the implied volatility is also crucial for a straddle because this strategy typically profits from large price movements. A High IV may raise the premiums and potentially improve profits if the stock price moves significantly. However, if the stock remains stagnant, the straddle can suffer from time decay (theta).

Samco’s Options Pro: The Secret to Redefining Options Strategy Building

The examples discussed above reveal how difficult it is for the average trader to factor in various Greeks and the IV for each strategy. Given the volatility of the options market, such in-depth analysis is often beyond human capability, especially if you are executing multiple strategies using different options contracts.

Here’s where Options Pro — the new feature in the Samco Securities trading app — can make a world of difference. With this revolutionary, industry-first feature, you can easily find the three best options strategies curated specifically for you based on your market outlook.

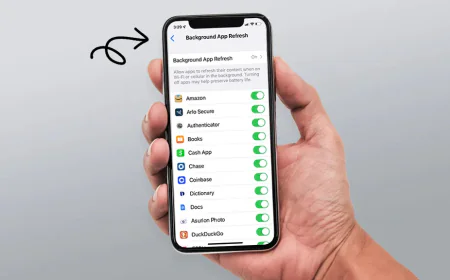

Here’s how you can leverage this feature to elevate your options trading:

● Step 1: Log into the Samco trading app.

● Step 2: Select the ‘Options Pro’ feature.

● Step 3: Search for the options that you wish to trade in.

● Step 4: Select the expiry for the options.

● Step 5: Then, choose your view about the underlying stock or index from the available options, namely bullish, bearish, neutral and volatile.

● Step 6: If you have a bullish or a bearish outlook, select the target you expect the underlying asset to hit.

● Step 7: Submit your inputs to receive suggestions about the top three options trading strategies that align with your outlook.

Reasons Samco’s Options Pro is a Game Changer for Options Traders

Introducing Options Pro, a game-changer in Samco’s trading app for Indian options traders. With over 1,000 strategies, it recommends optimal options tailored to your risk appetite and financial goals. You can customize searches based on funds, loss tolerance, and profit probability. Each strategy comes with detailed insights, including risk levels, profit potential, and analysis tools like statistical data and Greeks. Execute chosen strategies instantly, saving time and enhancing efficiency in volatile markets. Options Pro streamlines trading, empowering you to seize opportunities without hassle. Experience revolutionary options trading with Samco’s Options Pro – the future of trading is here.

To get more information, please visit: Samco Securities

If you have any objection to this press release content, kindly contact pr.error.rectification@gmail.com to notify us. We will respond and rectify the situation in the next 24 hours.