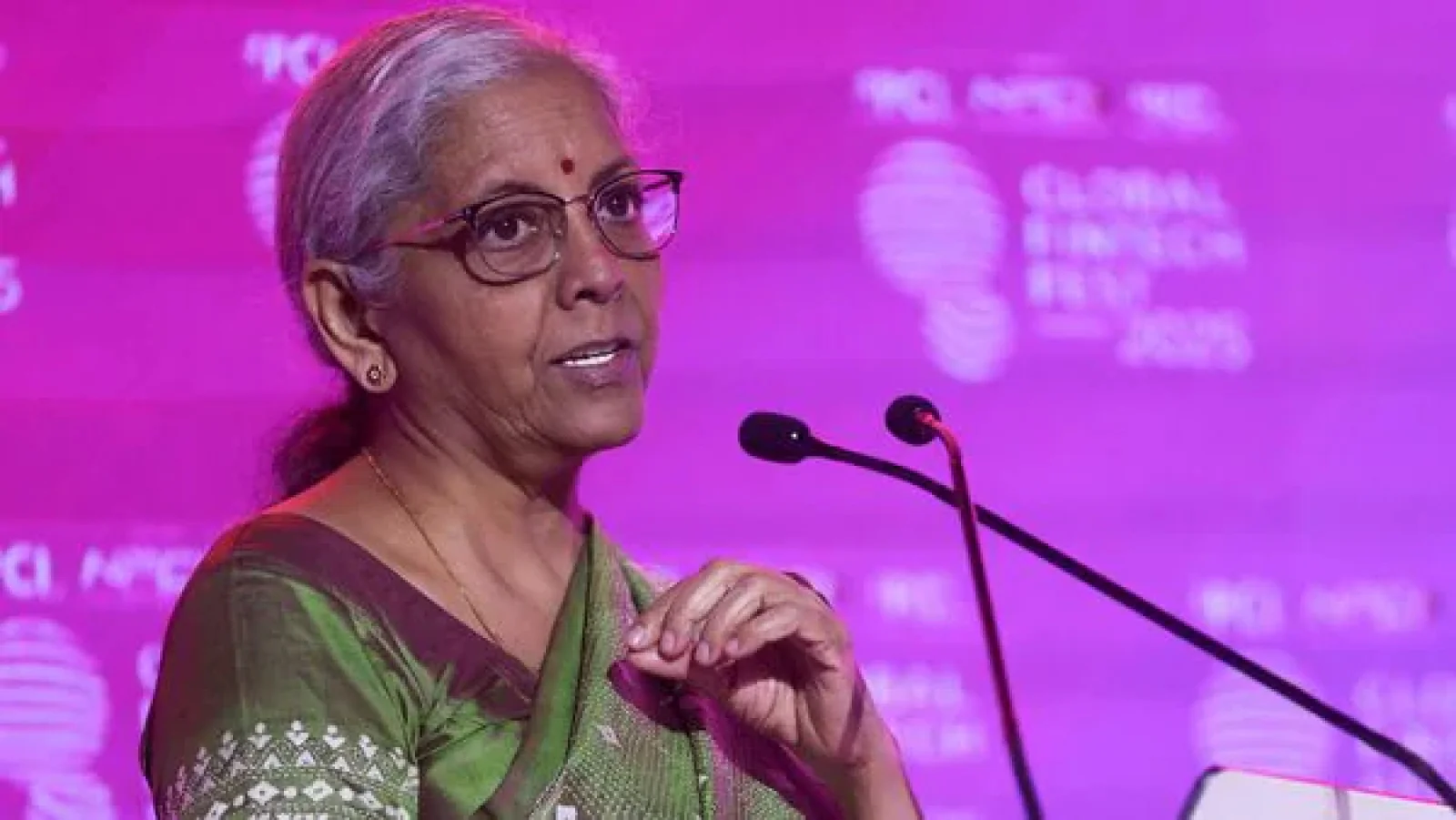

FM Nirmala Sitharaman Calls for Creation of Large, Global-Class Banks Through Possible Mergers

Top 100 Banks: More Indian banks may soon be included in the world's top 100 banks. RBI Governor Sanjay Malhotra said that the strong growth of the banking sector and economic expansion is leading to the emergence of several Indian banks on the global stage.

RBI Governor Sanjay Malhotra said that with the current economic expansion and growth witnessed in the banking system, many more Indian banks would be included shortly in the list of the world's top 100 banks. At present, only SBI and HDFC Bank feature among the world's top 100 banks. The two banks rank at 43rd and 73rd, respectively.

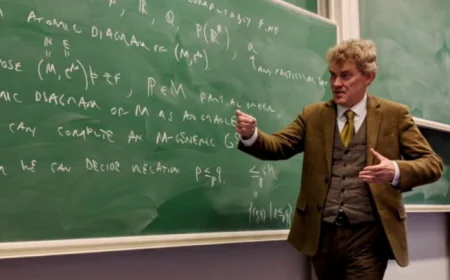

Malhotra, who was addressing students after the VKRV Rao Memorial Lecture at the Delhi School of Economics on Thursday, said the RBI cannot include many of India's largest banks in the global list, which should be included. He said, there are many banks in the public and private sectors. At the pace at which they are growing, I believe it is only a matter of time before several of our banks are among the top 100 in the world.

Finance Minister Nirmala Sitharaman said earlier this month that the country needs large, global-class banks. This cannot be achieved by creating new banks. Mergers could also be a way forward. Discussions are ongoing with the RBI and financial institutions in this regard. The RBI Governor stated that many public and private sector banks are growing rapidly. The Finance Minister has also stressed the need for global-class banks.

Want to get your story featured as above? click here!

Want to get your story featured as above? click here!

Public sector banks (PSBs) achieved a record total profit of ₹1.78 lakh crore in the financial year 2024-25. This is a 26% increase from the year before. During 2023-24, 12 public sector banks earned a total profit of ₹1.41 lakh crore.

The RBI Governor said the central bank has not set any target level for the rupee. The recent fall in the domestic currency against the US dollar is due to increased demand for the dollar. Malhotra said the recent devaluation of the Indian rupee is due to trade activities and US tariffs. We do not set any target level. Why is the rupee falling? It is due to demand. There is demand for the dollar and when it increases, the rupee falls. The RBI has a good foreign exchange reserve. There is no need to worry about the external sector.