Shri Keshav Cement and Infra Q4 FY24 PAT Up By 214 Percent

Mumbai (Maharashtra) [India], May 27: Shri Keshav Cement & Infra Limited (BSE – 530977), engaged in the manufacturing of Cement and Solar Power Generation and Distribution in the state of Karnataka has announced its Audited Financial Results for the Q4 FY24 & FY24. Key Financial Highlights Q4 FY24 •Total Income of ₹ 36.85 Cr, YoY growth of [...]

Mumbai (Maharashtra) [India], May 27: Shri Keshav Cement & Infra Limited (BSE – 530977), engaged in the manufacturing of Cement and Solar Power Generation and Distribution in the state of Karnataka has announced its Audited Financial Results for the Q4 FY24 & FY24.

Key Financial Highlights Q4 FY24

•Total Income of ₹ 36.85 Cr, YoY growth of 13.67%

•EBITDA of ₹ 11.55 Cr, YoY growth of 33.83%

•EBITDA Margin of 32.05%, YoY growth of 502 Bps

•PAT of ₹ 2.41 Cr, YoY change loss to profit

•PAT Margin of 6.53%, YoY change loss to profit

•EPS of ₹ 1.42, YoY change loss to profit

Key Financial Highlights FY24

•Total Income of ₹ 128.99 Cr, YoY growth of 2.89%

•EBITDA of ₹ 41.45 Cr, YoY growth of 11.58%

•EBITDA Margin of 32.78%, YoY growth of 264 Bps

•PAT of ₹ 9.13 Cr, YoY growth of 213.85%

•PAT Margin of 7.07%, YoY growth of 476 Bps

•EPS of ₹ 5.84, YoY growth of 179.43%

FY24 Highlights • In FY24, the company’s Total Revenue saw a growth of 2.89%, reaching ₹128.99 crore compared to ₹125.37 crore in the previous year. • During FY24, revenue from the cement business amounted to ₹97.93 crore, from the solar business to ₹19.88 crore, and from other businesses to ₹8.63 crore.

Commenting on the performance, Mr. Venkatesh Katwa, Chairman of Shri Keshav Cement & Infra Limited said, “We are pleased to announce that our strategic initiatives are yielding significant benefits. In Q4 FY24, we experienced double-digit growth in our top line, accompanied by a 400-basis points expansion in EBITDA margins. This contributed to a remarkable increase in profit margins for FY24, a trend we expect to continue with an upward bias in the coming period.

Looking ahead, we anticipate additional benefits from economies of scale as we triple our plant capacity, achieve higher utilization rates, and enhance our solar capacity. These improvements, coupled with a robust outlook for cement demand, will further enrich our performance.

Our aim is to ensure sustainable business growth and strengthen our market position, with a continued focus on expanding our brand.”

Key Highlights For Q4 FY24 (January 2024 – March 2024)

Awarded for maintaining best quality of cement.

Received a prestigious award from the Bureau of Indian Standards (BIS), Hubli, for three years of consistent delivery of high-quality cement and zero product failures

Rating Upgrade

Infomerics Ratings upgraded the Company’s ratings from IVR BB+ with Stable Outlook to IVR BB+ with Positive Outlook

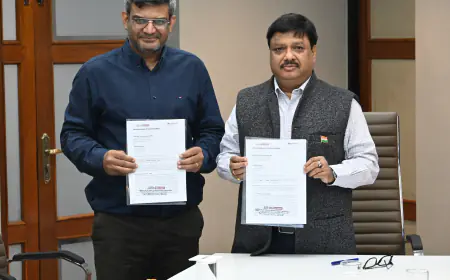

Allotment of shares in pursuant to conversion of warrants

Allotted 7.75 Lakhs & 12.50 Lakhs fully paid-up equity shares of ₹ 10 each at ₹ 130 per share to Saint Capital Fund & Team India Managers Limited on conversion of warrants issued to them on preferential basis

If you have any objection to this press release content, kindly contact pr.error.rectification@gmail.com to notify us. We will respond and rectify the situation in the next 24 hours.