Jocata launches One Case Manager enabling Financial Institutions comply by RBI’s single dashboard circular

Intelligent automation to simplify regulatory compliance processes for financial institutions New Delhi, 12th August 2024 – Jocata, a leading RegTech partner for the BFSI industry announces the pan-India rollout of its industry-first offering called ‘One Case Manager’. Jocata One Case Manager comes at a time when RBI circular dated January 2024 directs the regulated entities (REs) to adopt a single/unified dashboard to bring all stakeholders on one platform, showing all compliances in one place. The solution transforms how financial institutions monitor financial crime compliance by consolidating alerts from Anti-Money laundering (AML), Combating the Financing of terrorism (CFT), Real Time Fraud Risk Management (FRM), and Sanctions Screening onto a single platform, and builds a holistic view of customer risk across digital and non-digital transactions. The digital revolution has opened doors for massive transformation in the Indian BFSI industry. As per the Reserve Bank of India’s (RBI) annual report, digital payments in India grew by 44% YoY in FY 2023 - 2024 with UPI driving this growth and accounting for over 79.7% of total digital payments. As India is rapidly advancing towards a cashless and paperless economy, frauds have occurred predominantly in the category of digital payments. While current solutions in the market equip financial institutions with capabilities like AML/CFT, negative screening, and fraud detection, they are typically siloed due to different platforms for different use cases of financial crime compliance. As a result, investigators struggle to build a comprehensive customer risk profile. Jocata’s One Case Manager addresses these challenges by providing a unified platform tailored for banks, NBFCs, payments and insurance companies. It integrates the data from multiple platforms in use, establishing a holistic risk view of the customer thereby enhancing the effectiveness and efficiency of investigations. It facilitates seamless collaboration and information sharing within concerned teams with real-time communication eliminating redundant investigations and repetitive manual tasks. With intelligent automation, Jocata One Case Manager classifies and prioritizes cases, streamlining the triage process. Speaking on the occasion of this launch, Shailesh Deshpande, Director of Growth, Jocata said, “Working with marquee financial institutions for over a decade coupled with our expertise in the financial crime compliance ecosystem, we built Jocata One Case Manager that is designed to transform financial crime management in the BFSI industry. One Case Manager aggregates cases and alerts from disparate systems significantly improving productivity & empowering investigators to properly grasp the potential risk exposure in a single collaborative environment. Combined with our AI/ML-powered data analytics, financial institutions can analyse vast amounts of data, identify patterns, and flag suspicious transactions with more than 98% accuracy thus reducing false positives and making faster and better decisions. We’ve consistently worked with our partners to achieve sustainable growth with our world-class RegTech solutions. One Case Manager is a step further in assisting them to strike a balance between customers’ banking preference of “anytime and anywhere” and building a responsible and safe financial ecosystem.” Jocata’s RegTech arm has enabled large financial institutions in India and across various geographies with a robust financial crime compliance solution. It has empowered financial institutions to navigate complex and evolving regulatory compliance requirements with a comprehensive stack that can seamlessly and securely manage large volumes of data with the added power of data analytics. Jocata offers solutions including Customer Due Diligence & KYC Management, Negative Screening, AML Transaction Monitoring & Regulatory Reporting, Fraud Detection and Risk Categorization. About Jocata Jocata (a subsidiary of BillDesk) is a leading digital transformation partner for 50+ large financial institutions across India, ASEAN and the Middle East. Founded in 2010 and headquartered in India, Jocata offers a robust Financial Crime Compliance (FCC) product suite and expertise in driving efficiency to keep up with the dynamic & complex regulatory landscape. Jocata offers an integrated FCC solution comprising of Anti-Money Laundering (AML) & Regulatory Reporting, Negative Screening, Fraud Monitoring & Customer Risk Categorization. Jocata specialises in digital lending using credit automation, smart decisioning and intelligent monitoring. The purpose-built platform from Jocata powers enterprise lending programs for large banks and NBFCs. The highly configurable and low-code platform also operates in a SaaS model to enable analytics driven l

Intelligent automation to simplify regulatory compliance processes for financial institutions

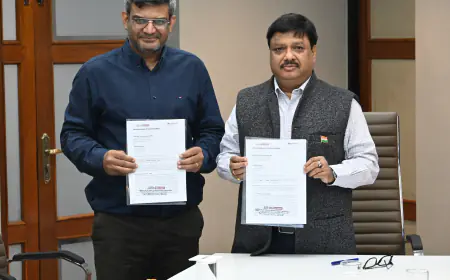

New Delhi, 12th August 2024 – Jocata, a leading RegTech partner for the BFSI industry announces the pan-India rollout of its industry-first offering called ‘One Case Manager’. Jocata One Case Manager comes at a time when RBI circular dated January 2024 directs the regulated entities (REs) to adopt a single/unified dashboard to bring all stakeholders on one platform, showing all compliances in one place. The solution transforms how financial institutions monitor financial crime compliance by consolidating alerts from Anti-Money laundering (AML), Combating the Financing of terrorism (CFT), Real Time Fraud Risk Management (FRM), and Sanctions Screening onto a single platform, and builds a holistic view of customer risk across digital and non-digital transactions.

The digital revolution has opened doors for massive transformation in the Indian BFSI industry. As per the Reserve Bank of India’s (RBI) annual report, digital payments in India grew by 44% YoY in FY 2023 - 2024 with UPI driving this growth and accounting for over 79.7% of total digital payments. As India is rapidly advancing towards a cashless and paperless economy, frauds have occurred predominantly in the category of digital payments. While current solutions in the market equip financial institutions with capabilities like AML/CFT, negative screening, and fraud detection, they are typically siloed due to different platforms for different use cases of financial crime compliance. As a result, investigators struggle to build a comprehensive customer risk profile.

Jocata’s One Case Manager addresses these challenges by providing a unified platform tailored for banks, NBFCs, payments and insurance companies. It integrates the data from multiple platforms in use, establishing a holistic risk view of the customer thereby enhancing the effectiveness and efficiency of investigations. It facilitates seamless collaboration and information sharing within concerned teams with real-time communication eliminating redundant investigations and repetitive manual tasks. With intelligent automation, Jocata One Case Manager classifies and prioritizes cases, streamlining the triage process.

Speaking on the occasion of this launch, Shailesh Deshpande, Director of Growth, Jocata said, “Working with marquee financial institutions for over a decade coupled with our expertise in the financial crime compliance ecosystem, we built Jocata One Case Manager that is designed to transform financial crime management in the BFSI industry. One Case Manager aggregates cases and alerts from disparate systems significantly improving productivity & empowering investigators to properly grasp the potential risk exposure in a single collaborative environment. Combined with our AI/ML-powered data analytics, financial institutions can analyse vast amounts of data, identify patterns, and flag suspicious transactions with more than 98% accuracy thus reducing false positives and making faster and better decisions. We’ve consistently worked with our partners to achieve sustainable growth with our world-class RegTech solutions. One Case Manager is a step further in assisting them to strike a balance between customers’ banking preference of “anytime and anywhere” and building a responsible and safe financial ecosystem.”

Jocata’s RegTech arm has enabled large financial institutions in India and across various geographies with a robust financial crime compliance solution. It has empowered financial institutions to navigate complex and evolving regulatory compliance requirements with a comprehensive stack that can seamlessly and securely manage large volumes of data with the added power of data analytics. Jocata offers solutions including Customer Due Diligence & KYC Management, Negative Screening, AML Transaction Monitoring & Regulatory Reporting, Fraud Detection and Risk Categorization.

About Jocata

Jocata (a subsidiary of BillDesk) is a leading digital transformation partner for 50+ large financial institutions across India, ASEAN and the Middle East. Founded in 2010 and headquartered in India, Jocata offers a robust Financial Crime Compliance (FCC) product suite and expertise in driving efficiency to keep up with the dynamic & complex regulatory landscape. Jocata offers an integrated FCC solution comprising of Anti-Money Laundering (AML) & Regulatory Reporting, Negative Screening, Fraud Monitoring & Customer Risk Categorization.

Jocata specialises in digital lending using credit automation, smart decisioning and intelligent monitoring. The purpose-built platform from Jocata powers enterprise lending programs for large banks and NBFCs. The highly configurable and low-code platform also operates in a SaaS model to enable analytics driven lending and embedded finance models for lenders, fintechs, neobanks, and marketplaces.

For more information please visit: https://jocata.com/one-case-manager/