Windfall tax on crude oil reduced to zero; Government took this decision on petrol, diesel and ATF

Windfall Tax: The last amendment in the windfall tax was made on August 31, when the windfall tax on crude petroleum was fixed at Rs 1,850 per tonne. Now it has been reduced to zero. SAED on the export of diesel, petrol, and jet fuel or ATF is already zero.

The government has reduced the windfall tax on domestically produced crude oil to 'zero' per tonne with effect from September 18.

It is levied as SAED and is revised every fortnight, that is, two weeks, taking the average prices of the fuel into consideration. The last revision was on August 31, when the windfall tax on crude petroleum was fixed at Rs 1,850 per tonne.

It has also kept the SAED on the export of diesel, petrol, and jet fuel or ATF at 'zero'. The new rates will apply from September 18, an official notification issued on Tuesday said.

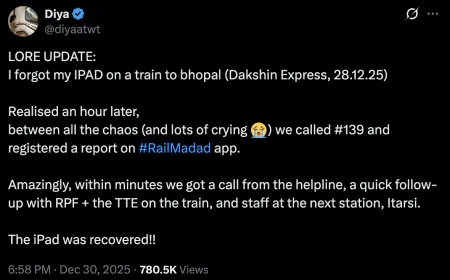

Want to get your story featured as above? click here!

Want to get your story featured as above? click here!

The windfall profit tax was implemented for the first time in India on July 1, 2022. It joined the list of countries that tax extraordinary profits of energy companies.