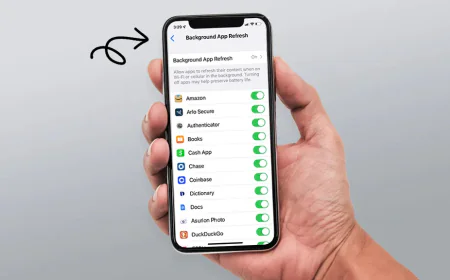

Why Should You Consider a Personal Loan App?

Personal loan apps have become increasingly popular in recent years. These apps allow you to apply for and potentially receive a loan directly from your smartphone. But here are a few reasons why you should consider a personal loan app:

Want to get your story featured as above? click here!

Want to get your story featured as above? click here!

Convenience

One of the biggest advantages of personal loan apps is convenience. Instead of going to a bank or credit union in person, you can apply for a loan from anywhere, at any time. This is especially helpful if you have a busy schedule or live far from traditional lenders.

You can usually complete the entire process through the app – from application to approval and receiving the money. This saves your time and hassle compared to traditional loan methods.

Speed

Personal loan apps often offer faster processing times than traditional lenders. While a bank might take days or even weeks to approve your loan, many apps can give you a decision within minutes or hours.

If approved, you might receive the money in your bank account within 1-3 business days. This quick turnaround can be crucial if you need money for an emergency or time-sensitive opportunity.

Easier to Compare Options

When you use a personal loan app, it's often easier to compare different loan offers. Many apps allow you to check your potential interest rate and loan terms without affecting your credit score. This is called a "soft inquiry" or "soft pull."

You can use multiple apps to see various offers and choose the best one for your needs. This comparison shopping is harder to do with traditional banks, where each application might require a "hard inquiry" that can temporarily lower your credit score.

Potentially Lower Interest Rates

Some personal loan apps offer competitive interest rates, especially for borrowers with good credit. These rates might be lower than what you'd get from a credit card or some traditional lenders.

However, it's important to remember that interest rates can vary widely depending on your credit score, income, and other factors. Always compare the annual percentage rate (APR) across different options to ensure you're getting a good deal.

No Collateral Required

Most personal loans offered through apps are unsecured, meaning you don't need to put up any collateral (like your car or house) to get the loan. This can be less risky for you as a borrower, though it often means the interest rates are higher than secured loans.

Flexible Loan Amounts

Personal loan apps often provide a wide range of loan amounts. You might be able to borrow depending on the app and your financial situation.This flexibility allows you to borrow only what you need, potentially saving you money on interest compared to taking out a larger loan than necessary.

Various Uses for the Money

A personal loan can be used for almost anything common uses include consolidating high-interest debt, paying for home improvements, covering unexpected medical bills, financing a large purchase, and paying for a wedding or vacation. The flexibility in how you use the money can make personal loans a versatile financial tool.

Potential to Improve Credit Score

If you use a personal loan to consolidate high-interest debt (like credit card balances) and make your payments on time, you might see an improvement in your credit score. This is because you're reducing your credit utilization ratio and establishing a history of on-time payments.

Fixed Repayment Terms

Many personal loans offered through apps have fixed interest rates and repayment terms. This means you will know exactly how much you need to pay each month and for how long. This predictability can help you with budgeting and design your financial planning.

Accessibility

Personal loan apps might be more accessible to some borrowers than traditional banks. Some apps consider factors beyond just your credit score when deciding whether to approve your loan. They might look at your education, job history, or other aspects of your financial life.

Conclusion

Personal loan apps offer many potential benefits, they can be a useful financial tool when used responsibly. If you are someone who is looking to take a personal loan you can choose apps such as the Tata Capital loan app. Also, if you are unsure whether a personal loan is right for you, consider speaking with a financial advisor as they can help you guide with a suitable decision for your unique financial situation.

For More Details Visit :-

https://play.google.com/store/apps/details?id=com.snapwork.tcl

https://www.tatacapital.com/personal-loan.html