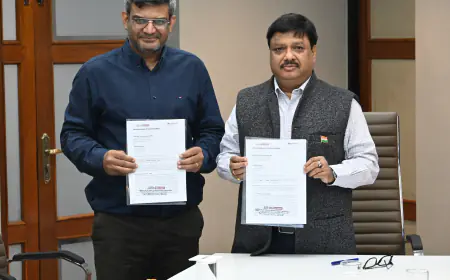

Udaya Kumar Hebbar and Manoj Nambiar elected as Chairperson and Vice-Chairperson in Microfinance Industry Network (MFIN)

New Delhi (India), August 2: Microfinance Industry Network (MFIN), the premier association and RBI-recognised Self-Regulatory Organization (SRO) for the microfinance industry announced the election of Mr. Udaya Kumar Hebbar, MD & CEO, CreditAccess Grameen Ltd. as Chairperson and Mr. Manoj Kumar Nambiar, MD of Arohan Financial Services Ltd. as the Vice Chairperson at its 14th […]

New Delhi (India), August 2: Microfinance Industry Network (MFIN), the premier association and RBI-recognised Self-Regulatory Organization (SRO) for the microfinance industry announced the election of Mr. Udaya Kumar Hebbar, MD & CEO, CreditAccess Grameen Ltd. as Chairperson and Mr. Manoj Kumar Nambiar, MD of Arohan Financial Services Ltd. as the Vice Chairperson at its 14th AGM.

Mr. Udaya Kumar Hebbar took the reins from Mr. Devesh Sachdev, MD & CEO of Fusion Micro Finance Ltd. while Mr Manoj Kumar Nambiar from Mr. Vivek Tiwari, MD & CEO of Satya MicroCapital Ltd., on completion of their respective term.

Mr. Manoj Kumar Nambiar and Mr. Vineet Chattree, Director – Svatantra Microfin Pvt. Ltd., were elected to the Governing Board by MFIN Members through an election process. The House bid farewell to outgoing Member, Mr Dibyajyoti Pattanaik, Director – Annapurna Finance.

On the occasion, Mr. Udaya Kumar Hebbar, MD & CEO, CreditAccess Grameen Ltd. said, “I am deeply honoured for being entrusted along with the Board, to steer the microfinance industry as a balanced, responsible, and sustainable sector lending at the bottom of the pyramid. The industry has demonstrated a strong cross-cycle resiliency over the past two decades and has only grown stronger with every passing year. It is at an inflection point, buoyed by sanguine macroeconomic environment, harmonised microfinance regulations, and strong governmental support. MFIN will continue to play its crucial role of financial inclusion for the underserved, maintaining responsible self-regulations, protecting the customer’s interest, and fulfilling responsibilities towards all stakeholders.”

Speaking on assuming the role of Vice Chair, Mr. Manoj Kumar Nambiar, MD of Arohan Financial Services Ltd (an Aavishkaar Group company), said, “I am delighted to be back on the MFIN Governing board as a Vice Chair as it transitions to a broad-based microfinance body across banks and non-banks covering the entire sector. This is even more important at a time where the industry looks to grow in scale and size impacting millions of women at the Bottom of the Pyramid segment.”

Welcoming the new Chair and Vice Chair to the board, Dr. Alok Misra, CEO and Director – MFIN said, “There could not have been a more opportune time to have Mr Udaya Kumar Hebbar and Mr Manoj Kumar Nambiar, veterans in the microfinance industry, to lead MFIN’s Board. As both have held positions on the board earlier and are familiar with the need of the hour as MFIN positions itself to emerge stronger as an integrated body representing all RBI registered REs (Regulated Entities), their role in carving out the future of Microfinance is going to be critical. I look forward to working with them to ensure sustainable growth of the industry.”

With the new Chair and Vice Chair, the 7 Member Board now includes Mr Abhisheka Kumar, MD – Sindhuja Microcredit Pvt Ltd, Mr Ankush Golechha, Director – Aviral Finance Pvt Ltd., (representing the medium and small MFIs respectively), Mr Vineet Chattree, Managing Director – Svatantra Microfin Pvt. Ltd., Mr. Amardeep Singh Samra, MD and CEO, Midland Microfin Ltd., and Mr George K John, Executive Vice President – ESAF Small Finance Bank (representing Banks, Small Finance Banks, NBFCs, BCs among others).

About MFIN (Microfinance Industry Network):

MFIN is a premier industry association comprising 55 NBFC-MFIs and 44 Associates including Banks, Small Finance Banks (SFBs) and NBFCs. By virtue of bringing all microfinance entities under one common umbrella, MFIN acts as a bridge between them and the regulators to build a dialogue for greater transparency, better policy frameworks and stronger client protection standards for responsible lending, thus enabling the microfinance industry to partake in meeting the larger financial inclusion goals.

If you have any objection to this press release content, kindly contact pr.error.rectification@gmail.com to notify us. We will respond and rectify the situation in the next 24 hours.