Government may reduce tax rates to increase consumption, loss to government treasury will be compensated

Expectations from the budget: Reduction in personal tax can boost consumption in the economy as well as increase the savings of the middle class. Also, individuals earning Rs 15 lakh annually are expected to get tax relief from this.

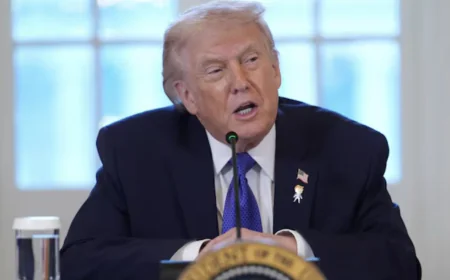

The government is considering lowering personal tax rates in several areas in the entire budget, which will be presented in July. This has the potential to boost domestic consumption. The loss to the government treasury caused by tax cuts can be partially offset by increased consumption among individual taxpayers in this group. According to post-election surveys, the National Democratic Alliance, led by Prime Minister Narendra Modi, has returned to power for the third time, but the BJP did not win a majority due to voter worries about high inflation, rising unemployment, and diminishing income. Nirmala Sitharaman, the Finance Minister, may present the comprehensive budget on July 22.

A cut in personal tax can boost consumption in the economy as well as increase middle-class savings. Also, it is expected to provide tax relief to individuals earning Rs 15 lakh annually. Annual income up to Rs 15 lakh is currently taxed at 5 to 20 percent. Income above Rs 15 lakh is taxed at the rate of 30 percent.

The post-election survey said that Indian GDP grew at a rate of 8.2 percent during 2023-24. Consumption has played an important role in this growth. If consumption increases due to a cut in tax rates, it will support GDP.

Want to get your story featured as above? click here!

Want to get your story featured as above? click here!

When a person's income increases five times from Rs 3 lakh to Rs 15 lakh, the personal tax rate increases six times. This makes people upset. The government may also consider reducing personal tax rates for annual income of Rs 10 lakh. A new threshold for income tax is being discussed at the highest rate of 30 percent in the old tax system.